How to Spot a Fake IRS Letter

Fake IRS letters are going around again. I want to arm you with the information you need so that you never get scammed by a fake IRS letter.

I’ll provide a few examples, and after reading this blog post, you’ll have the information you need to never get tricked by an IRS scam letter.

Spotting a fake IRS letter, email, message, or whatever you get, is easy to detect as long as you follow a couple of guidelines.

First off, when initiating contact with you:

1. The IRS won’t email you.

2. The IRS won’t send you a text message.

3. The IRS won’t contact you via social media.

4. The IRS won’t call you. Generally speaking. Unless you’ve already been communicating with them. In that case, it’s possible that they could call you.

These four guidelines should help you eliminate 80% of the fake IRS notices that are sent out by scammers.

Here’s an email that was recently going around:

When you first look at it, it looks legitimate. But, if you remember my four guidelines… The IRS won’t email you. So right off the bat you should ignore and delete the email.

If you’re still not sure, then scrutinize the email message. You’ll typically find errors.

It says Dear Tax Payer. Taxpayer should be one word and not two.

It also refers to the status of your 2023 income tax return. Depending on when you're reading this, you likely haven’t filed a 2023 tax return, since they aren’t due until April of 2024.

You can also look at the sender information and look at where the “reply to” is addressed. But, you don’t have to even do all that. If the IRS notice came by email, then it’s most likely 100% fake.

So, let me repeat the guidelines to remember. The IRS won’t email you. The IRS won’t send you a text message. The IRS won’t contact you via social media. And the IRS won’t call you, unless you’re already in communication with them regarding a tax matter.

So the only thing you really need to be careful with, are IRS letters that come in the mail. These are less frequent, probably because of the cost of mailing, but scammers do send them.

Here’s how to spot a fake IRS letter.

1. Look for spelling mistakes.

2. Look for bad grammar.

3. Look for incorrect information

4. Google the phone number and address.

Applying these filters should allow you to authenticate an IRS letter by yourself.

One important thing to note, with ChatGPT and AI, fake IRS letters could become harder to detect.

Ultimately, if you’re not sure, you can always call the IRS at 1-800-829-1040, and talk to an IRS employee. They can let you know definitely if they sent out a letter.

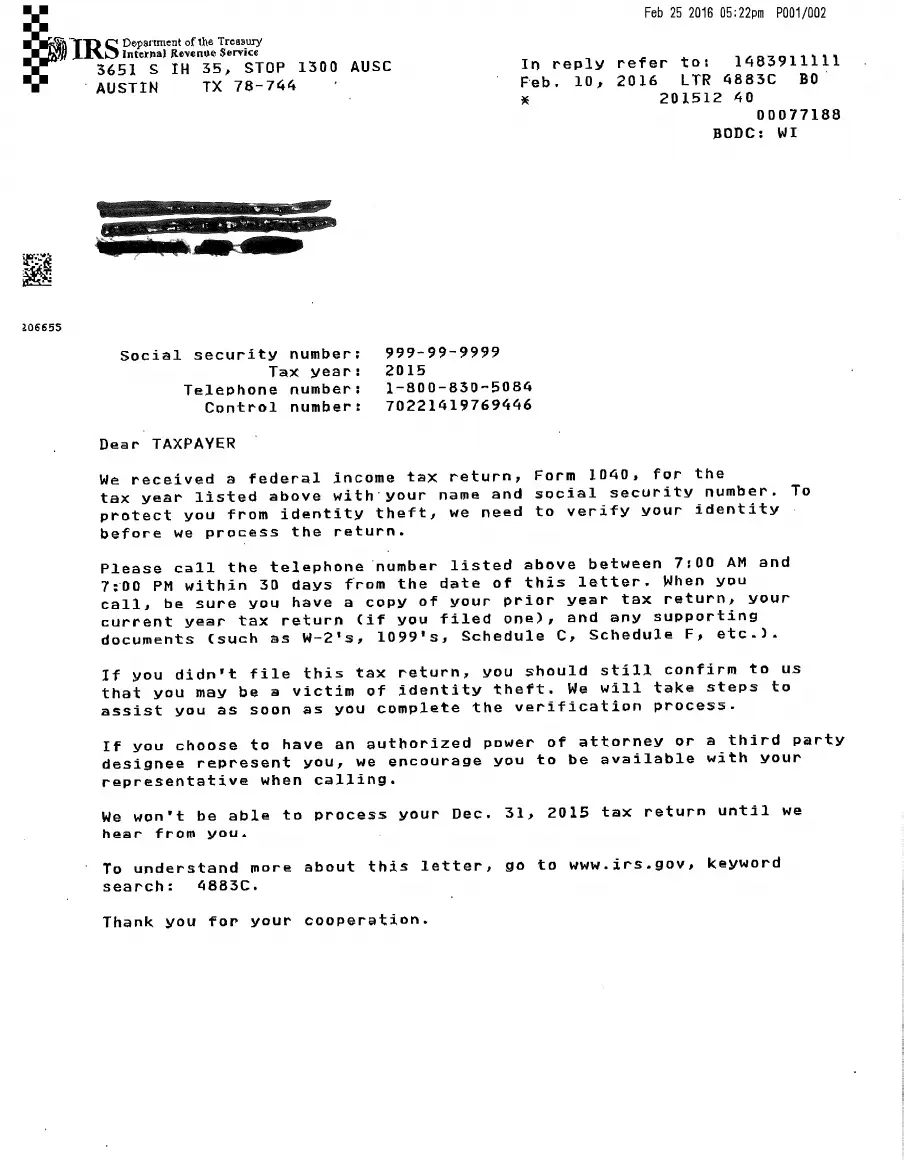

So, let’s look at this next letter and apply the filters.

This is an older fake letter, but it does look pretty good.

1. Okay, let’s look for spelling mistakes… the spelling looks pretty good.

2. Let’s look for bad grammar… Okay, third paragraph.

“If you didn’t file this tax return, you should still confirm to us that you may be a victim of identity theft.”

Okay, that sentence is bad English… “you should still confirm to us that you may be a victim of identity theft.”

3. Let’s look for incorrect information.

Okay, social security number up here, it has all nines. A real letter would have your social security number or at least a partial indication of your social security number.

4. If you google the phone number 1-800-830-5084, it actually checks out.

But, the way this scam works, is they include a payment voucher going to a fake address, where the scammers get your money, and you’ll never get it back. In this case, calling the IRS would have confirmed it was a scam or fake IRS letter.

More recently though, the way they’re scamming people is by getting you to call a fake number, where you’re actually calling a scammer or IRS impersonator. And that person convinces you that you owe the IRS money, and that, you’ll go to jail, if you don’t buy some prepaid gift cards to give them over the phone.

Just remember that the IRS never initiates contact with taxpayers by email, text or social medial regarding a bill or tax refund!!

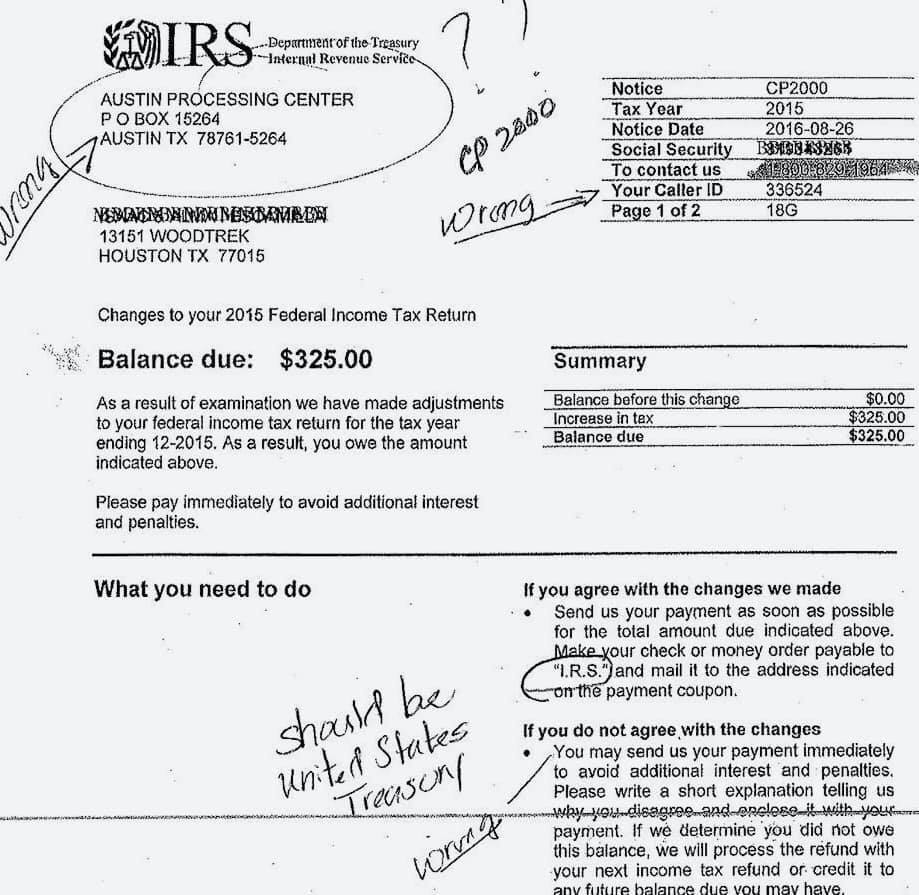

Okay, here’s another one:

This one actually looks pretty convincing, but naturally, there are some glaring things that tell you it’s a scam IRS letter.

For example, up here on the left, the address is all wrong. If you google it, you’ll see that it is not a valid IRS address.

Down here, it says make your check or money order payable to “I.R.S.”. This is wrong since payments should be made to the United States Treasury.

Ultimately, if you get a call, email or text message from someone saying their from the IRS, just hang up and delete the message.

Now if you get a letter in the mail, you need to look that over carefully. Use my tips to help you determine if the letter is real or not. When in doubt, talk to your tax professional or call the IRS directly at 1-800-829-1040..

Thanks for watching and see you in the next blog post!