Fort Knox Secrets: Why America’s Gold Will Never Face a Real Audit

Trump and Musk Said They’d Audit Fort Knox. Then... Silence.

In early 2025, Donald Trump made a bold promise. Speaking at a campaign event, he declared he was going to open the doors to Fort Knox, count the gold, and livestream it with Elon Musk. Musk was in. He tweeted that it was "the people’s gold" and the public deserved to see it.

The media went wild. Supporters got excited. Even skeptics raised eyebrows.

But then—nothing happened.

No visit.

No livestream.

Not even a follow-up.

The idea died quietly. The gold stayed hidden.

And the real question became: Why?

The Fort Knox Gold: What the Government Claims

According to the U.S. Treasury, here’s the official breakdown:

-

The U.S. owns 8,133.5 metric tons of gold

-

About half of that is stored at Fort Knox

-

The rest is held at the Denver Mint and West Point

Fort Knox is secured like a military base. Concrete bunkers, armed guards, fences, alarms—it’s not exactly tourist-friendly. And the public has no access.

Now, here’s where it gets suspicious: there hasn’t been a full, independent audit of that gold since 1953.

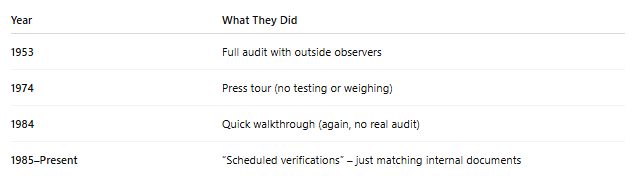

Let’s look at what really happened over the years:

That’s it.

No full audit.

No third-party inspection.

No physical testing or bar-by-bar verification in 70+ years.

Why Did the Trump-Musk Audit Suddenly Disappear?

Let’s go over the timeline:

-

January 2025: Trump says he wants to count the gold

-

February 26, 2025: He repeats it on national TV

-

March 2025: Musk confirms interest in livestreaming the audit

-

April 2025: Both go completely silent

Not a word since.

Did someone warn them off? Did national security concerns get raised? Or did they learn something that made them back off?

Nobody knows.

And that’s the problem.

What Jim Rickards Thinks: The Gold May Be Rehypothecated

Jim Rickards, an economist and former government advisor, doesn’t say the gold is missing.

His theory?

It’s been promised out multiple times on paper.

It’s called rehypothecation—when assets like gold are lent, leased, or traded again and again.

So while the bars may physically sit inside Fort Knox:

-

Central banks could be leasing them out

-

ETF funds could claim them as backing

-

Paper contracts could have multiple owners per bar

Some say each bar could have 50 to 100 paper claims on it.

That means the gold exists—but if everyone asked for physical delivery at once, it would trigger a massive crisis. Possibly a total collapse of confidence in the system.

Gold: Enemy of the Dollar?

Let’s be clear. The Federal Reserve doesn’t like gold.

Why?

Because gold is competition to fiat currency.

When gold rises sharply, it signals a loss of trust in the dollar. That’s why, historically, governments have worked to keep it suppressed or out of the spotlight:

-

In 1933, FDR confiscated gold from citizens and made private ownership illegal

-

In 1971, Nixon closed the gold window and ended the gold standard

-

In 2011, Fed Chair Ben Bernanke said gold was "not money"

But if gold is useless, why are central banks buying it like crazy?

Why is the U.S. still guarding it with military force?

And why are presidents and billionaires mysteriously dropping plans to show it to the public?

Something doesn’t add up.

What the 2024 “Audit” Actually Was

In 2024, the U.S. Treasury said it had “verified” the gold at Fort Knox. The media ran with it like a real audit had taken place.

But here’s the truth:

-

No one opened the vault

-

No weighing or testing

-

No physical verification

-

No third-party oversight

They basically checked a spreadsheet. That’s not an audit. It’s paperwork. And for an asset supposedly worth hundreds of billions, it’s unacceptable.

As a CPA, I can say with confidence: a true audit requires physical validation.

What If They Did Audit It?

Let’s say they open the vault tomorrow and do a full audit.

Here’s what might happen:

-

Maybe the gold is all there—but it’s already leased out

-

Maybe they find missing bars or mislabeling

-

Maybe there’s nothing wrong, but the process reveals just how weak oversight has been

Any of those outcomes could rattle markets, shake public confidence, or worse—spark a run on the gold market.

That’s likely why no one wants to take the risk.

Why This Matters for You

You might be wondering, “Why does Fort Knox even matter to me?”

Here’s why:

-

Gold backs confidence in the dollar

-

If the gold isn’t there—or is claimed by others—faith in U.S. debt collapses

-

That could send the dollar falling and inflation soaring

Meanwhile, central banks are quietly stacking gold.

They know something.

And they’re not waiting around to see what happens.

So, Is the Gold There?

We don’t know.

And that’s the point.

Without an audit, there is no proof.

No verification.

No transparency.

It’s all based on trust—just like fiat currency.

Final Thoughts

Fort Knox hasn’t been truly audited in over 70 years.

Trump and Musk hyped an audit, then dropped the idea without a word.

Experts believe the gold is there—but it may be owned on paper by dozens of other parties.

And if the truth came out, it could shake the dollar, the markets, and global trust in the U.S. financial system.

What Do You Think?

Is the Fort Knox gold real?

Is it leased out to the point of crisis?

Why does the government avoid a real audit?

Head over to the YouTube video and leave your thoughts in the comments.

Let’s hear what you think!

Stay informed. Stay grounded. And don’t stop asking questions.